How to Use Trade Finance to Reduce Risk When Selling Internationally / New Delhi

Description

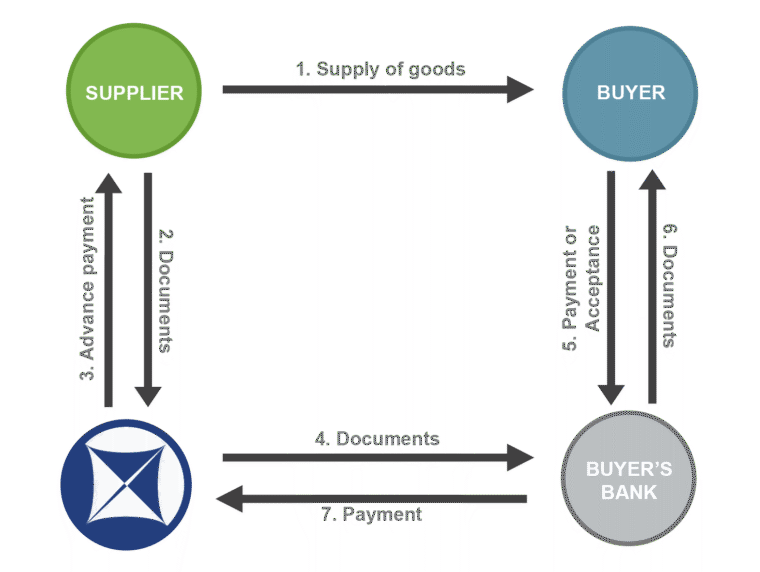

Taking risks is inherently uncertain and can be scary when your business is involved. Breaking the mold of what your company is accustomed to can have a huge payoff — and doesn’t have to be all that worrisome. Take, for example, the decision to sell internationally. Leaving the comfort of selling only domestically and expanding into new markets abroad comes with unfamiliar elements. These might include political instability in the country where your products are shipped, a different local legal system to navigate, varying economic stages across the world, the prospect of currency exchanges, and buyers who have their own idea of what they want the payment schedule to be. Don’t fret. Trade finance tools like factoring finance can help your company tackle these challenges and do business globally with success. PROTECTING CASH FLOW WITH TRADE FINANCE Let’s start with the last challenge mentioned: payment. When you choose to work with buyers in different countries, there’s a good chance they’ll want to pay 30, 60, 90, or even 180 days after the invoice has been prepared and goods are shipped. These payment terms can quickly drain your liquidity and affect your ability to pay your employees and your own suppliers. Trade finance can play a vital role in preventing working capital shortages and equipping your company with the cash flow necessary to keep operations running smoothly. This financing technique involves the purchase of your company’s receivables by a financial intermediary who, in return, provides you with cash upfront and collects payment from your buyers at invoice maturity. With this financial support, your company can accommodate the long payment terms requested by buyers while still paying workers and vendors on time. The financing arrangement not only makes your customers happy, it also ensures your supply chain partners have the liquidity to produce raw materials and meet their own costs. Since the international trade finance partner you choose to work with handles the collection of payment from your buyer, wherever they are located, participating in global trade becomes more secure and more manageable. In addition, if your customer cannot make payment due to buyer insolvency, the financial intermediary who bought your receivables will still pay you what you are owed. Non-recourse financing, or post shipment financing that provides credit protection on receivables, further reduces the risk when conducting cross-border transactions. OVERSEAS VARIABLES With the payment part covered, the next factors to prepare for relate to the condition of the country you’re selling into or your export market. It’s no mystery that different parts of the world undergo economic and political turmoil. Sometimes, there’s national unrest, but tensions between countries exist too, such as trade wars and sanctions. Partnering with an international trade finance company can guide your business through these obstacles using a flexible and creative funding approach to the situation at hand. Since trade finance solutions are tailor-made to unique circumstances, your business can find comfort knowing there is a way around issues that arise. It should also be mentioned that international trade finance is anchored by expertise on both a large and small scale. Trade finance professionals know how trade works from a high-level perspective but can also inform a situation based on their knowledge on the local level. This comes in handy when dealing with different country legal systems. Trade finance experts decipher the legal aspects of your cross-border transactions, allowing your business to focus on their products rather than on the fine print. Trade finance is also a powerful tool when managing different trade destinations. The COVID-19 pandemic, for example, has left many economies at varying stages of recovery, if they’re even bouncing back yet. Not to mention, currency exchange is another thing to contend with. An international trade finance company, leveraging their local knowledge, global scale, and flexibility, can solve the problem of discrepancies that exist among countries. Funding, for instance, can be structured in the preferred currency your business requests. And if supply chains are rattled from crises like the pandemic, they can finance extended payment terms that blunt the blow to the economy and ensure you get paid, no matter the economic upheaval. FINAL THOUGHTS Yes, selling internationally comes with its share of risk. But trade finance virtually reduces that risk by providing immediate capital, supplying credit protection and collection services, using a flexible approach to financing, and leveraging the expertise of professionals on both a large and local scale. With trade finance, your company can capitalize on growth opportunities in new markets knowing they are backed by a financial intermediary who has their security and best interests in mind.

To know more: https://www.tradewindfinance.com/news-resources/how-to-use-trade-finance-to-reduce-risk-when-selling-internationally »

Related Ads

Bangalore, Karnataka

Bangalore, Karnataka

Bangalore, Karnataka

Mumbai, Maharashtra